The bioprocess industry today increasingly uses single-use technologies (SUTs) to bring speed, flexibility, and cost efficiency to processes. This was not the case just 15 years ago. What led us here and what does it mean for what lies ahead?

The rise of single-use technologies

Today we might take SUTs in biomanufacturing for granted. These existing solutions are readily available to help shorten time to market and increase productivity. However, to understand where SUTs are headed, we looked back at where they began. Want the quick version of what we found? Check out this infographic on the evolution of single-use technologies. For a longer version, keep reading.

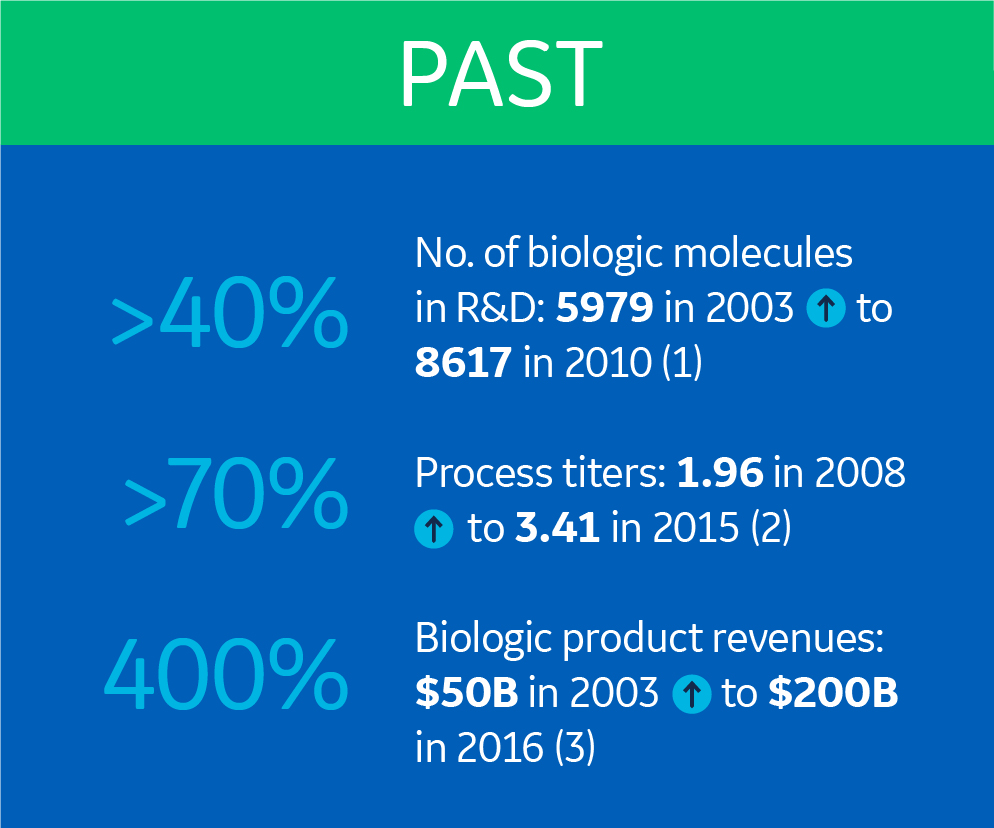

Let’s visit the biomanufacturing industry 15 years ago. Both the number of biologics in R&D pipelines and upstream process titers were increasing, but were nowhere near where they are today (1,2). And biologic product revenues were only about a quarter of what we saw in 2016 (3).

This growth meant new challenges for the biopharmaceutical industry. The need for improved flexibility, efficiency, and speed increased. And so did the urgency to produce at a smaller scale to a lower cost. SUTs, like single-use bioreactors and chromatography systems, emerged as a response to these needs.

Enhanced solutions, different challenges

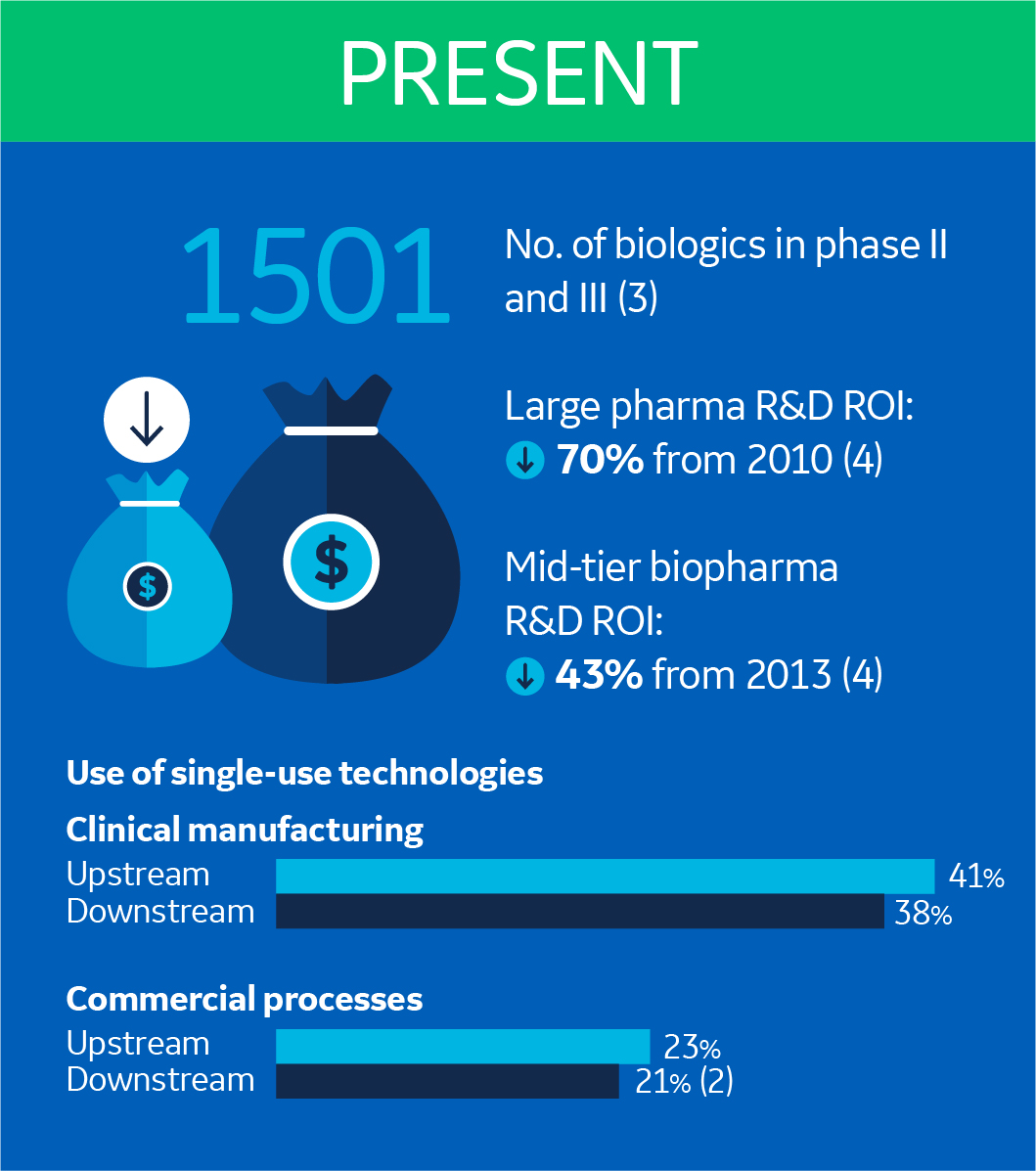

Today we see SUTs in both clinical and commercial processes, and the use continues to grow. For example, more than a fifth of all commercial processes use SUTs in their downstream and upstream process trains (2).

What’s behind this evolution? For one, there are even more molecules in late clinical phases (3). But there is also a pressing business reality driving these changes. We continue to see a decrease in return of investment (ROI) on R&D investments for both large and mid-tier pharmaceutical companies (4).

This all boils down to the fact that increasing productivity and accelerating drug development are right up top on biomanufacturers’ desired outcomes. Another common priority is risk mitigation linked to creating manufacturing capacity. Predesigned facility solutions pave the way for answers to this challenge.

What lies ahead?

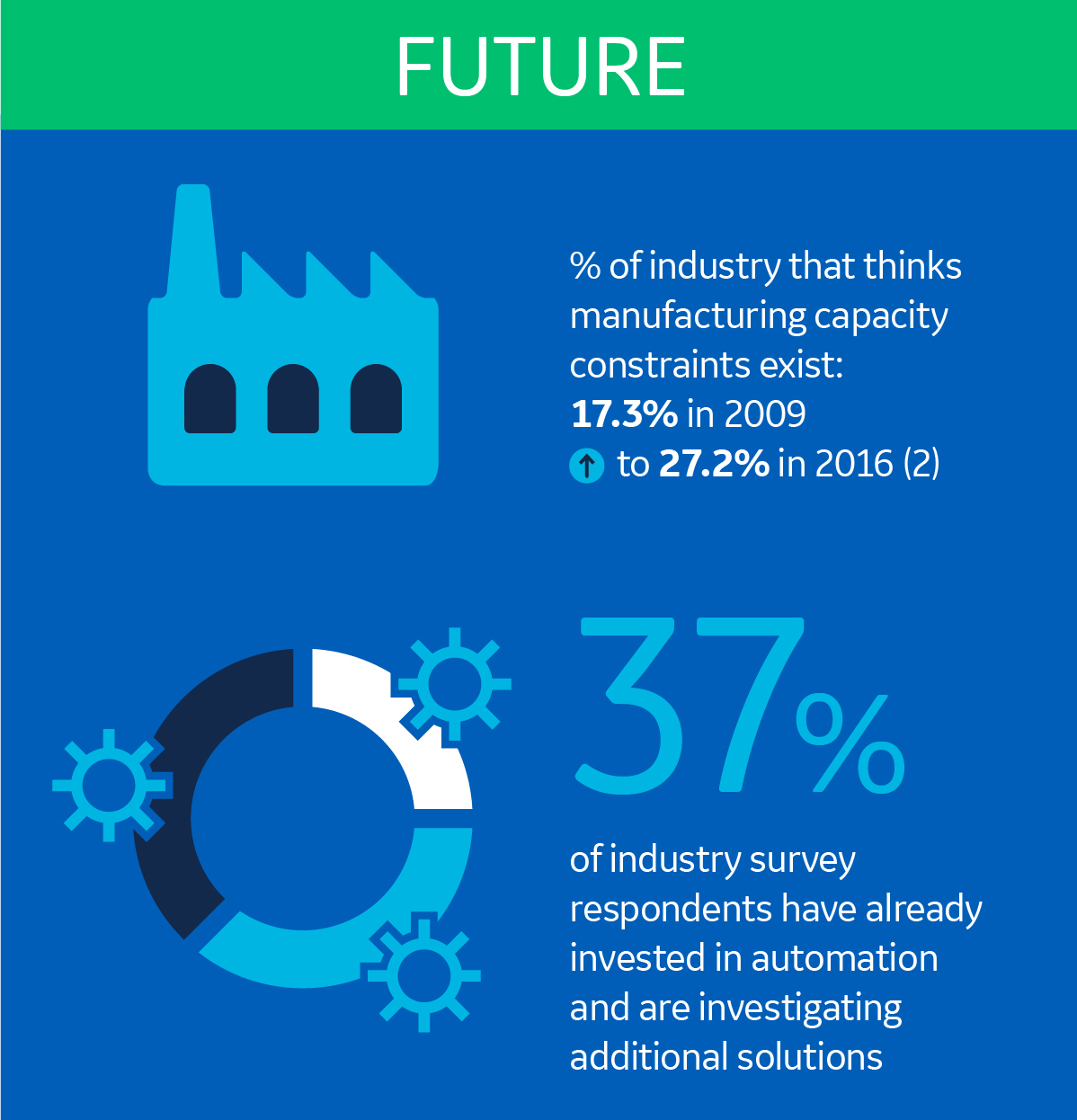

By understanding how SUTs have solved past challenges, we can make some predictions about what’s to come. It’s safe to say that capacity will be an increasingly important consideration for biomanufacturers. As a matter of fact, in 2016, the number of people who considered manufacturing capacity constraints to be a high-priority issue had doubled since 2009 (2).

Moving forward, the industry will be looking for improved consistency and productivity as well as greater business performance. This is probably why many have already invested in automation solutions, which is what our internal study showed.

As popular as SUTs have become today, we don’t see signs that the technology will slow in creating value for the biopharmaceutical industry, even as manufacturers’ needs and challenges evolve. So, what are the single-use bioprocessing innovations of the future? Download this infographic to find out.

References

1. Biopharmaceutical R&D Statistical Sourcebook 2015/2016, PAREXEL (2016).

2. 13th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, BioPlan Associates, Inc. (2016)

3. Data from EvaluatePharma database

4. A new future for R&D? Measuring the return from pharmaceutical innovation 2017, Deloitte report [Online]https://www2.deloitte.com/uk/en/pages/life-sciences-and-healthcare/articles/measuring-return-from-pharmaceutical-innovation.html