Successes in the clinic have placed many cell and gene therapies on an accelerated route to market. But unless developers consider, at an early stage, how they might produce their product at scale, they may run into problems with commercial manufacturing. Here, we present an article based on an interview with Carol Knevelman (Vice President, Head of Process R&D at Oxford Biomedica), who shared a case study on large scale lentiviral vector production at Cytiva’s “Bioprocess Days” event in May, 2019. Carol offers her advice for developing a futureproof commercial process.

Many cell and gene therapies are on an accelerated route to market – sometimes skipping phase III trials entirely. With early stage development so close to commercial launch, there’s little time to develop an appropriate manufacturing process for commercial supply. This can leave the commercial process looking rather different in terms of production modes and impurity profiles compared to the initial process, and this may necessitate lengthy bridging studies. Because of the fast track nature of these therapies, process knowledge can also be lacking, which can result in extended process characterization studies. All of these factors can delay time to market. Another problem is that the differences between European and American regulatory frameworks can be difficult to navigate.

In the current landscape, most of these therapies come from an academic research environment where, at the preclinical stage, many of the materials used are marked for research only, and are often undefined and uncontrolled. At the clinical stage, these materials must be replaced with GMP-grade materials where it can be difficult to find alternative suppliers or certified materials with equivalent properties. As you transition to GMP-grade materials, the risk associated with the process will decrease, but this will come with greater costs – especially with cell and gene therapies, where products can be priced at $0.5 million to $2.2 million per treatment. We found the complexity of the supply chain for our initial adherent process to be particularly challenging when moving into the clinical arena. Oxford Biomedica had 54 global suppliers for over 400 different components with this process – operating at varying temperatures. There were over 1000 line items required for each batch, which, as you can imagine, created considerable risk. This was considerably streamlined prior to process performance qualification.

Building a vector

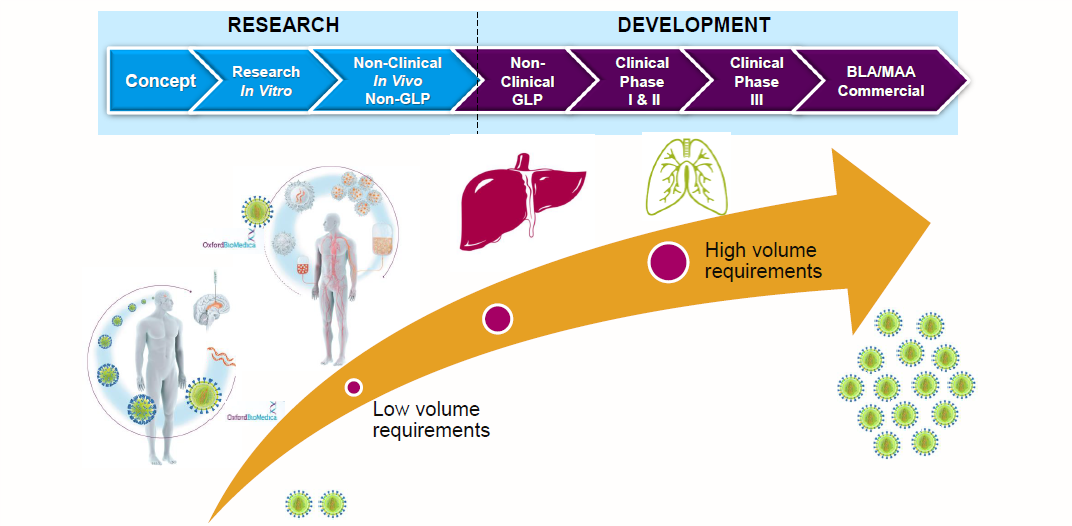

Given the myriad challenges, how did we develop a workable manufacturing plan for a commercial process? Speaking from our experience in developing lentiviral vectors for cell and gene therapies, as well as working with companies to apply our technologies to their manufacturing processes, the first step to success involves understanding what is required for your therapy to succeed. For example, the therapeutic area will influence the amount of vector that needs to be made; programs that deliver therapies directly to the brain will have vastly lower volume requirements compared to therapies delivered to organs such as the liver or lungs.

Investing early to get ahead of future demands is also important. For our process, we invested early in suspension cell culture, which is serum and animal component free. Suspension processes can be scaled up relatively easily and can operate in fed-batch or perfusion mode to deliver productivity gains. But there were still many challenges. Vectors are incredibly fussy and sensitive to almost anything that is required for successful manufacture in suspension: pH, temperature, shear forces and so on. Removing impurities within the product stream is also difficult because of salt sensitivity, the mixture of host-cell protein and DNA, plasmid DNA, as well as empty, inactive vectors that can’t transduce your target cells.

Fig 1. Typical manufacturing strategy considerations.

The solution was to select appropriate scaled-down models for process development. This was crucial given that development at the larger scales would be very expensive with our process! These scaled-down models allowed us to identify the optimum physio-chemical environment within our bioreactors. We were also able to identify initial critical process parameters, as well as much of the necessary engineering characterization to define the scaling criteria required to move forward. Once we had this knowledge, we were able to then identify GMP systems on the market that could satisfy our requirements – in our case, these were all single-use. The preparatory work allowed us to cut costs by minimizing the number of the scale-up evaluations that are typically needed – which is also beneficial because it can reduce overall development timelines and enable faster market access.

Future challenges

Although the majority of development work was performed in the scaled down models, there were some elements that required evaluation at larger scales. For example, in transitioning from an adherent process to a suspension process, we saw an iterative improvement in upstream titers by a factor of 10 to 20 fold, plus the three fold increase in scale. The increased titers, however, did not initially fully translate from our 5 L scale down bioreactors to our larger scale bioreactors. However, after identifying where the problems were with additional process development, we were able to achieve the same titers in our 50 L and 200 L bioreactors as in our scale down models.

This is sufficient for many of the vector quantities that are required by our partners and should see them through commercial supply for their therapies. But it’s still not enough for some indications we’re working with, so we will continue to innovate to ensure that we’re able to deliver sufficient vector for all indications One such innovation is in an automated cell screening system we have invested in to speed up the selection of cell lines for our packaging and producer cells.

Demand for vector product will only increase throughout the industry as it matures. Indeed, there is already a shortage of vectors as current technologies struggle to keep pace with the expansion of gene therapies from ultra-rare to larger indications. I believe that the success of the industry hinges, in part, on further innovation in vector production platforms and vector purification, in particular. Vendors must continue to improve the scalability and availability of their systems. Here, much can be leveraged from the pharma industry.

I envisage the cell and gene therapy industry transitioning to more intensified processes through integrated continuous processing, automation and digitalization for data management, and single-use systems to improve speed to market. These provide opportunities for achieving cost-efficient, large-scale vector production and achieving the right quality to meet patient needs.