By David Radspinner and Firman Ghouze at Cytiva

Looking across the landscape of the biopharmaceutical industry, there is more promise than ever to effectively serve global healthcare needs. In 2017, the FDA approved five biosimilar products, paving the way for “follow-on biologics” to be a key factor in global market growth over the next 10 to 15 years.1 Other promising advancements, such as the development of cancer immunotherapies Keytruda™ and Opdivo™ and the rise in antibody drug conjugates (ADCs) and gene and CAR T-cell therapies, show the growing pace of therapeutic and molecular innovation. The refined understanding of disease biology that has led to these exciting developments is driving the industry to target smaller patient populations, meaning the growing number of biologic drugs coming down the pipeline, especially when combined with improved potency of therapies, will be manufactured in smaller volumes.

Not only does this increase the need for more flexible and efficient manufacturing, but it also intensifies the spotlight on the long-standing problem of managing demand uncertainty in biologics production. Traditional stainless-steel facilities can take four to six years to build, which requires construction to begin several years before you even know if your product will be approved, let alone be successful. If you end up underestimating demand, you must, as quickly as possible, procure additional capacity. In the meantime, you are creating a drug shortage for patients in need of treatment. If you overestimate demand, you end up with unused capacity.

Now, advances in technology and innovation have created new options for biopharma, including pre-fabricated modular facilities, which can be built in as little as 18 months. However, while the shorter timeline for construction of a modular facility allows drug production to begin sooner, other functions are needed for drug manufacture and distribution. You must still procure the land, obtain permits, and begin construction of brick and mortar areas for a manufacturing site, such as office space, laboratories, warehouses, and other support facilities. Addressing these obstacles—and added costs—is possible, but it requires a risk-averse industry to embrace the innovative new concept of a shared biomanufacturing facility. Through this business model, you can mitigate the risks of demand uncertainty using a flexible solution that allows you to grow and change in the new paradigm of biomanufacturing.

The efficiencies of a biomanufacturing community

It is clear the rise of single-use technology (SUT), as well as the plug-and-play functionality of the ballroom concept, have introduced new opportunities for flexible manufacturing. Flexibility was the inspiration behind Cytiva’s ready-to-operate, cGMP-compliant KUBio facilities equipped with the single-use bioprocessing platform, FlexFactory. This biomanufacturing solution can be 25 to 50 percent more cost-effective than traditional facilities. The project timeline is condensed due to the ability to prepare the site, produce the modules, and manufacture the processing equipment simultaneously. On-site assembly of the facility is accomplished in a matter of days, and Cytiva handles the project from start to finish, providing a single point of contact as well as valuable experience from several projects.

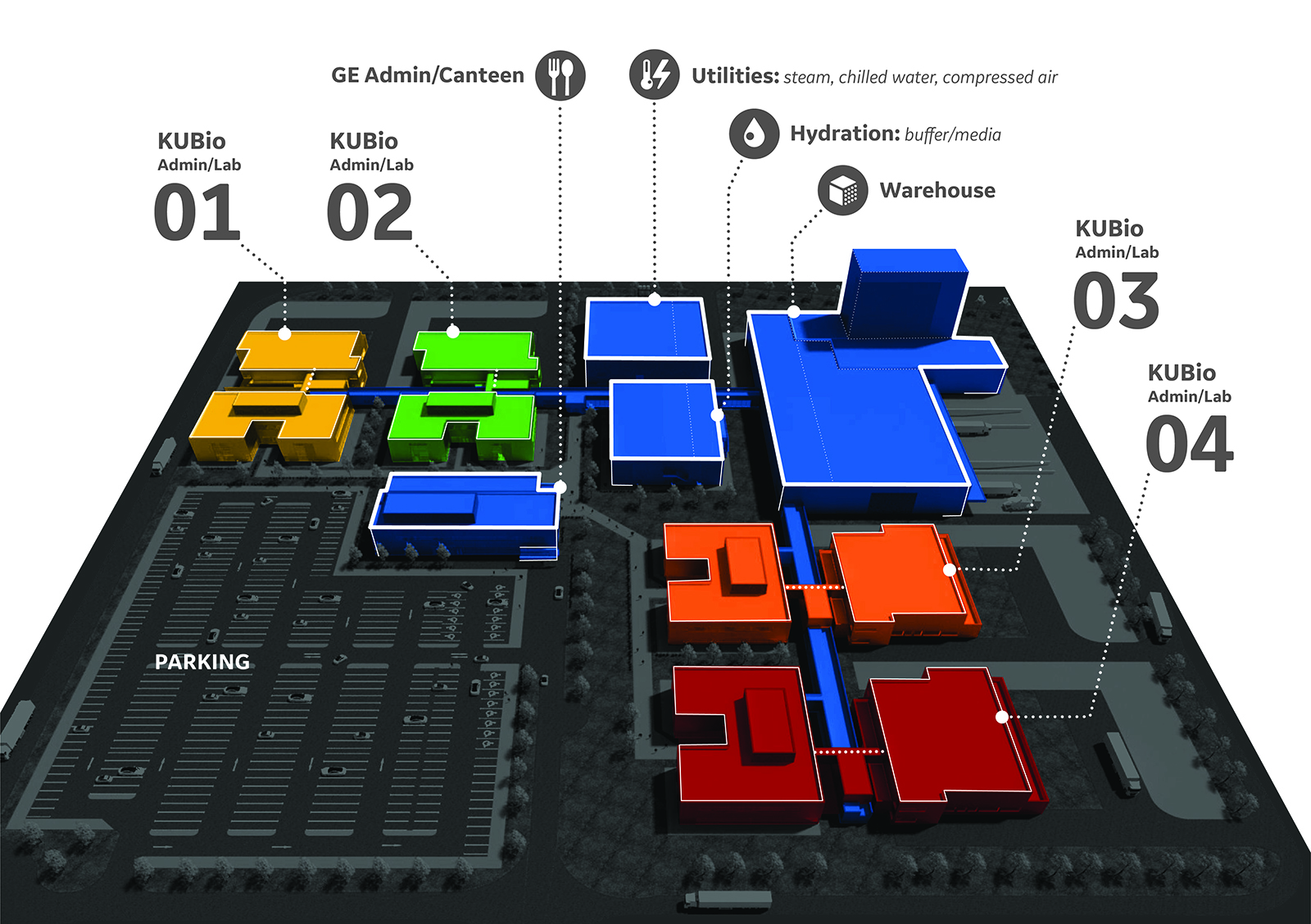

Taking efficiency and speed to market one step further, though, is Cytiva's BioPark bioprocess complex. This business model assures segregation of the proprietary manufacturing sites while Cytiva maintains the shared elements, such as warehousing, utilities, and hydration. Specifically, each complex can include up to four KUBio facilities functioning independently from one another. The “community” of biomanufacturers operating in the complex is connected to Cytiva support buildings via a centralized spine, which is used to:

- Move quality approved materials and finished goods between the customer-owned KUBio and shared warehouse and hydration facility

- Allocate cGMP utilities, such as electricity and process water for steam from the central utility building to all of the buildings on the site and to provide waste water and physical/chemical waste removal

Raw materials are brought into the shared warehouse or generated inside of the hydration facility under tightly controlled processes and stored in secure warehouse space segregated for each KUBio owner. The warehouse, to which only Cytiva personnel have access, houses the necessary powdered media, buffer, resins, filters, and any other specified consumables. Cytiva also offers quality control and laboratory services, such as inspection of incoming raw material, quality testing, and environmental monitoring. Now, you can reduce the fixed overhead cost of your workforce to a variable cost by using a shared group of employees for these activities. By eliminating the need for these personnel used across a traditional facility, Cytiva estimates its customers would save $1.8 million a year. In addition, KUBio owners will also have access to shared grounds, including parking and a cafeteria.

Reducing the risks of demand uncertainty

The financial risks associated with demand uncertainty are greatly reduced in a BioPark by only requiring a deposit to reserve a KUBio manufacturing space. With this option, you can wait until Phase 3, when there is efficacy data that suggests either appropriate or poor returns, allowing you to delay any major decisions about capacity and save on up-front investments that could be lost later if your product is not successful. If the facility is no longer required, you are not obligated to complete—or pay for—the build of the KUBio facility. When you are able to make the most appropriate choice of facility and technology, you can significantly impact the time and capital risks of building manufacturing infrastructure.

As the facility is being built, customers can utilize Cytiva's Fast Trak process development services in parallel. Fast Trak centers replicate a real-life industrial setting, where Cytiva is able to optimize the development process and facilitate tech transfer, giving you the ability to make adjustments to your process. And unlike other potential capacity solutions, Cytiva does not own any rights or receive any royalties for the drugs produced in the BioPark KUBio facilities and each KUBIO facility is under the complete control of the owner.

Promoting global growth

The BioPark design also allows for global flexibility, giving companies the opportunity to build in growth economies around the world, where there is a production shortage due to a lack of appropriate infrastructure and talent.

In Guangzhou, China, the government has invested in a complex of KUBios for what is being referred to as a “biocampus.” The goal is to promote innovation in an area that currently serves as the biggest emerging market for pharmaceuticals. The other areas of the complex, such as the warehouse and hydration facility, will still be Cytiva owned and operated. By establishing fertile ground for the biologics market, the Guangzhou government hopes to encourage growth for both big and small companies and create a market of affordable drugs for its growing population.

The regulatory approach to a shared campus

The pharmaceutical industry has always been one that is slow to change and for good reason. Every decision can potentially affect millions of patients and no one wants to make the wrong one. Regulatory scrutiny, in particular, is always a factor when considering a change to your processes, as this can open you up to complex and lengthy reviews. While the BioPark concept is outside the norms of traditional drug manufacturing, everything can still be controlled within a geometric manner to facilitate your manufacturing needs. Therefore, it still fits within the same regulatory framework as any other facility. For example, in terms of cross contamination between products being made by different companies within a shared complex, there are still physical controls in place via closed processing and facility segregation.

Additionally, it is critical that every aspect of the supply chain is well characterized and in control. A BioPark campus can improve security of supply, but the interfaces between supplier and pharmaceutical manufacturer adjust from a classical model. From a quality perspective, the BioPark offers a unique and improved approach to raw material testing. With the warehouse in such close proximity, you can leverage the QC work already done on the raw materials by Cytiva rather than repeating the same test a day later simply because it was moved 500 feet across the parking lot.

Cytiva has collaborated—and continues to collaborate—with regulators, who have expressed interest in and support of a shared campus model, as regulatory agencies recognize there is a need to do things differently. After extensive reviews and assessments, the agencies Cytiva has worked with are also comfortable with Cytiva's approach to regulatory submissions and inspections. Specifically, KUBio owners are responsible only for their own building and operations. Any of the shared services on the campus run by Cytiva are registered and inspected separately, and only Cytiva is responsible for any corrective actions.

Preparing for the future of biomanufacturing

Single-use technology has a critical role in the future of manufacturing, as it can eliminate costly and time-consuming cleaning and changeover costs and deliver more productive manufacturing time. For these reasons and others, startup companies may have a vested interest in KUBio facilities, as they must utilize their cash efficiently and cannot make a big investment in infrastructure. At the same time, KUBios also offer an economic solution to larger companies that want to drive down the costs of global expansion. Furthermore, a shared campus gives any biomanufacturer the ability to minimize its investment while maximizing time to market. And in today’s industry, being first to market gives you the competitive edge that is critical to meeting your goals and pushing your company’s potential to its limits and beyond.

About the authors

David Radspinner, General Manager, USCAN/LATAM and BioPark, Cytiva

David is the General Manager for Cytiva's BioPark business and commercial USCAN and LATAM business. He led the integration of the cell culture (HyClone) business and held numerous roles in product management and business development at Thermo Fisher Scientific. David earned a Ph.D. in analytical chemistry from the University of Arizona and spent over 14 years in developing, manufacturing, and characterizing pharmaceuticals for several multinational pharmaceutical companies.

Firman Ghouze, Director Commercial Strategy, Cytiva.

Firman is responsible for developing Cytiva's commercial strategy and partnerships in the bioprocess space. He has worked in the biomanufacturing industry, encompassing both protein and cell therapeutics, for the last ten years. Firman has experience supporting large pharma, biotech, hospitals, and governments in the US, Europe, and Asia to support the analysis and development of effective business outcomes. Previously, he has held several roles in Cytiva, including product management, corporate strategy, marketing, business development, risk analysis, and R&D.

References:

1. Biologics Blog, US Biosimilar Approvals Soar in 2017 — https://www.biologicsblog.com/us-biosimilar-approvals-soar-in-2017