In a letter to doctors on New Year’s Eve, the UK’s chief medical officers made an important point about the Covid-19 vaccination program: “Vaccine shortage is a reality that cannot be wished away”.1

For the profession, the message was a reminder that challenges were still to come, despite the emergence of multiple vaccines. For biopharma industry observers, meanwhile, the chief medical officers’ warning was a symptom of a perennial issue.

The biopharma industry has grown increasingly dependent on a global supply chain for the manufacturing and distribution of medicines. This has driven cost efficiencies through economies of scale, but it also makes it vulnerable to bottlenecks.

A complex tangle of processes across multiple countries vastly increases the potential for pain points in the biopharma supply chain, and these have knock-on effects that ultimately delay production. In a pandemic, that is both more likely and more catastrophic.

At this critical point, how is the supply chain performing? Findings from Cytiva’s Global Biopharma Resilience Index suggest a mixed picture.

Drug shortages are common

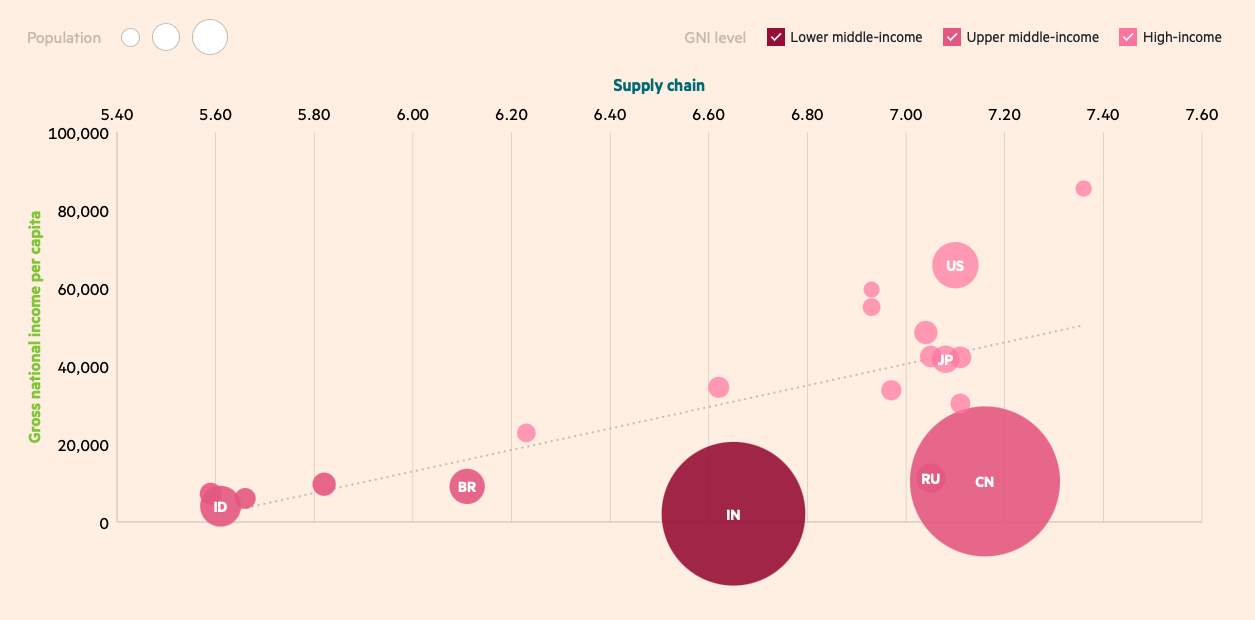

While 50% of executives and policymakers in the survey say their country never experiences shortages of critical medicines such as insulin, this drops to 26% for more specialized areas such as oncology biologics. Respondents from countries with a lower gross national income (GNI) per capita — Indonesia and Thailand, for instance — are more likely to report shortages. For example, 32% of respondents in Indonesia say that their country experiences shortages of oncology biologics more than once a year, compared with none in Switzerland and just 4% in the US.

Meanwhile 51% of executives say that drug shortages increased in their domestic market during the pandemic, although 33% say that the issue had been increasing over the past five years. This points to underlying issues around supply chain resilience, which have been exacerbated — but not caused — by the pandemic.

Part of the problem of supply chain security is the reliance on others. About half of the executives and policymakers surveyed (47%) say their country is moderately or highly dependent on the import of drugs, which illustrates the sheer expanse of the drug production and delivery process. China and India in particular have become the epicenters of production for the generics and active pharmaceutical ingredients (APIs) that form so much of the industry’s output. Any breakdown in the supply chain here would create serious problems.2

“I think even before the current crisis companies were rethinking their supply chains,” says Roberto Gradnik, a physician and the chief executive of Ixaltis, a biotech start-up. “They were moving away from really extreme globalization.”

Is it the end of an era?

Survey respondents agree with Gradnik. Six in 10 executives (59%) say that the era of offshoring drug manufacturing to low-cost countries is over, and 67% say that the manufacturing of biopharma staples such as biologics would dramatically increase in their own countries over the next three years.

The need to build resilience at home is not just an imperative for countries with a lower GNI per capita. Countries such as Switzerland and the US — among the top five countries for supply chain resilience (see chart 1) — acknowledge that they are vulnerable to scarcity. Figures from the US Food & Drug Administration, for example, show that the US currently has more than 100 drugs in short supply;3 that includes opioid active ingredient morphine sulfate, a key painkiller ingredient, and pindolol tablets used on patients with hypertension.

Chart 1: Lower GNI per capita countries are fragile on their supply chain

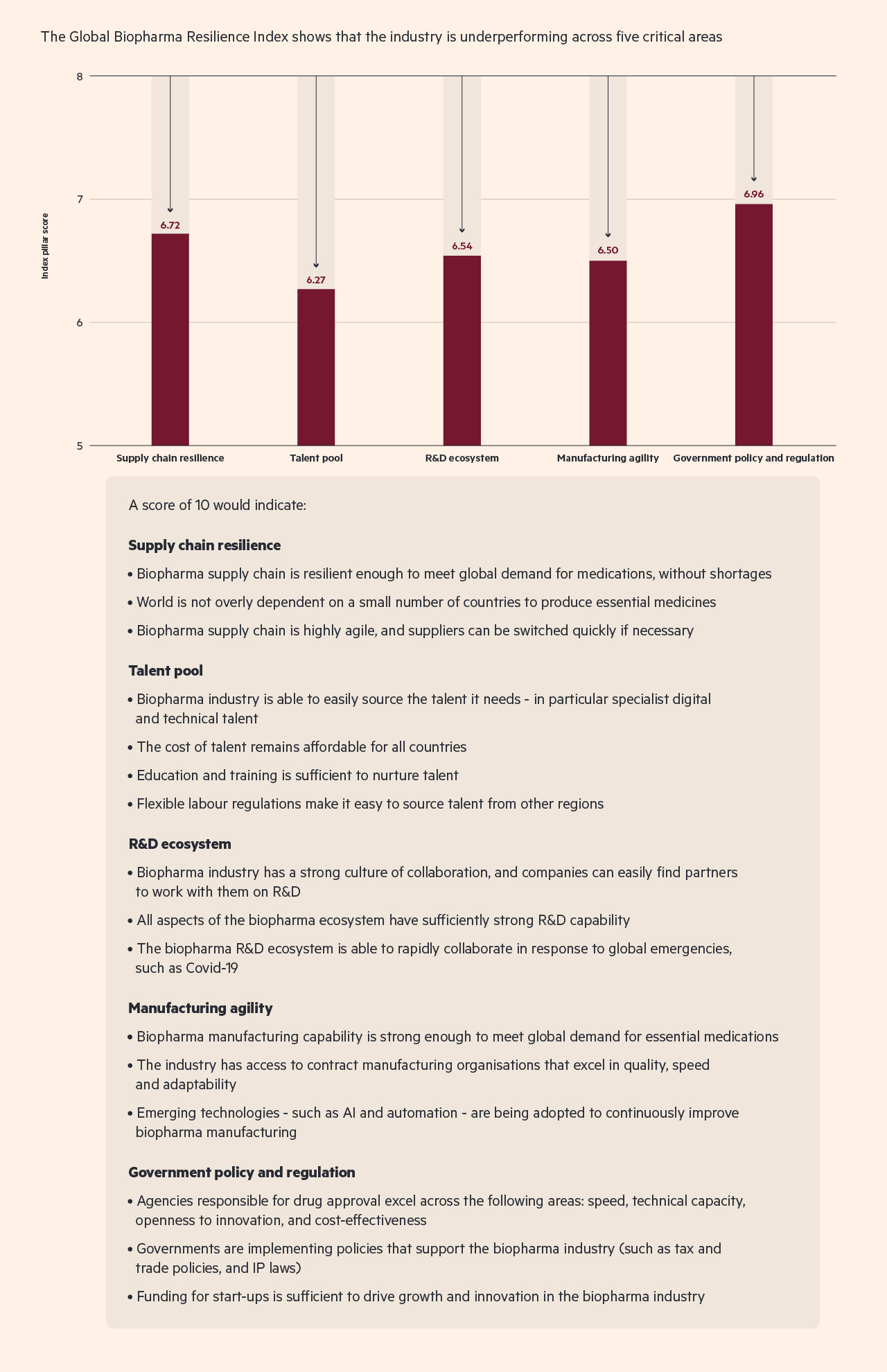

These shortfalls are a concern. And although the Global Biopharma Resilience Index indicates that the biopharma supply chain performs better than other aspects of the industry (see chart 2), there are still a number of areas that need improvement.

The way the industry addresses this weakness will vary from country to country. But increasing domestic production while securing stronger networks with suppliers globally could give it the agility it needs to keep operations running smoothly.

Take Chinese firm WuXi Biologics, for example. With about a decade of experience in the manufacturing portion of the supply chain, the company has rapidly become a key partner for the pharma giants. Dr Chris Chen, WuXi Biologics' chief executive, is acutely aware of the risks to global supply chains brought on by Covid-19, but he is of the view that these global bases need reinforcement, while domestic operations are enhanced.

“We are building a very significant facility in Ireland, we have also purchased two facilities in Germany, and we are building a facility in the US,” says Chen. “There will still be a global supply chain. There will be some efforts to build local supply chains but it may not be that easy.”

Martin Meeson, chief executive of Fujifilm Diosynth Biotechnologies, believes that some elements of the supply chain, such as packaging, can benefit from localization. But he also advocates for stronger global collaboration. “The cost of building a biopharma facility is in the billions,” he says. “And it would certainly not be economically viable for every country to try to put such a facility in place. It would be far more efficient for the world if the level of collaboration that we currently see within the pharma industry is mirrored in the way that the governments interact, in order to use resources efficiently.”

Chart 2 : Much more work is needed to avert a supply chain collapse

More Key Insights from the BioPharma Resilience Index and our expert panelists on the changing BioPharma Supply Chain