At the end of 2019, when a novel coronavirus in Wuhan, China, began to emerge, many people were complacent about the risks – and no one predicted the intense global disruption that would occur. However, despite the resulting setbacks, the biopharma industry rose to the job of developing new vaccines and therapeutics. These companies have built new technologies, such as mRNA platform approaches, and embraced digital transformation. This increase in manufacturing capacity has been nothing short of remarkable – especially when considering that it is complex to manufacture vaccines, requiring specific know-how and equipment.

However, unplanned spikes in demand for raw materials, packaging, equipment, and consumables has resulted in supply chain disruptions to biopharmaceutical manufacturers. The need to manufacture COVID-19 vaccines and therapeutics, quickly and at-scale, has far reaching implications on wider biopharma manufacturers. And that intense pressure would have a serious impact on the production of essential medicines, if supply allocation and communication were executed poorly. In some cases, disruption continues today, with shortages in critical raw materials, such as polymers and microchip parts, affecting not just the biopharma industry but other industries as well. To ensure input supplies for current and predicted manufacturing capacity, short-, medium- and long-term solutions are needed.

Jon Van Pelt, General Manager, BioProcess Single Use & Enterprise Solutions at Cytiva, believes that suppliers have an important role to play in addressing the challenges. Cytiva, for example, has been working on well-thoughtout supply allocation and communication principles throughout the pandemic to ensure continuous supply of raw materials and technologies to its customers – enabling them to continue to produce life-saving drugs and vaccines. We caught up with Van Pelt to find out how Cytiva is making supply chains more reliant and embracing digital transformation to benefit customers.

What is your background at Cytiva?

I’ve been in the biopharma industry since 2015. Originally, I was the Americas Commercial Operations Leader at Cytiva, but I then transitioned into general management of our Enterprise Solutions business in 2016. In 2019, my responsibilities expanded further to include our single use technologies portfolio.

How has the COVID-19 pandemic affected the industry? Are there any silver linings?

I think everyone reading this is familiar with the material and supply chain constraints that have affected most industries throughout the pandemic. For biopharma, this has forced the industry to rethink the definition of supply chain flexibility and resiliency– and I suppose that can be considered a silver lining. First, being flexible; the industry had to find new ways to adapt because it was tasked with supplying important vaccines and other medicines. In addition to supporting the rapid development and deployment of COVID-19 vaccines and therapeutics, the industry is moving quickly to add the necessary capacity to support long-term growth in other areas. For resiliency, decentralizing supply chains has benefited the industry and product/raw material interchangeability has started to gain attention among the industry – fitting well with the implementation of ICH Q12 by major economies.

Has the pandemic affected specific supply chains? And is disruption still being seen today?

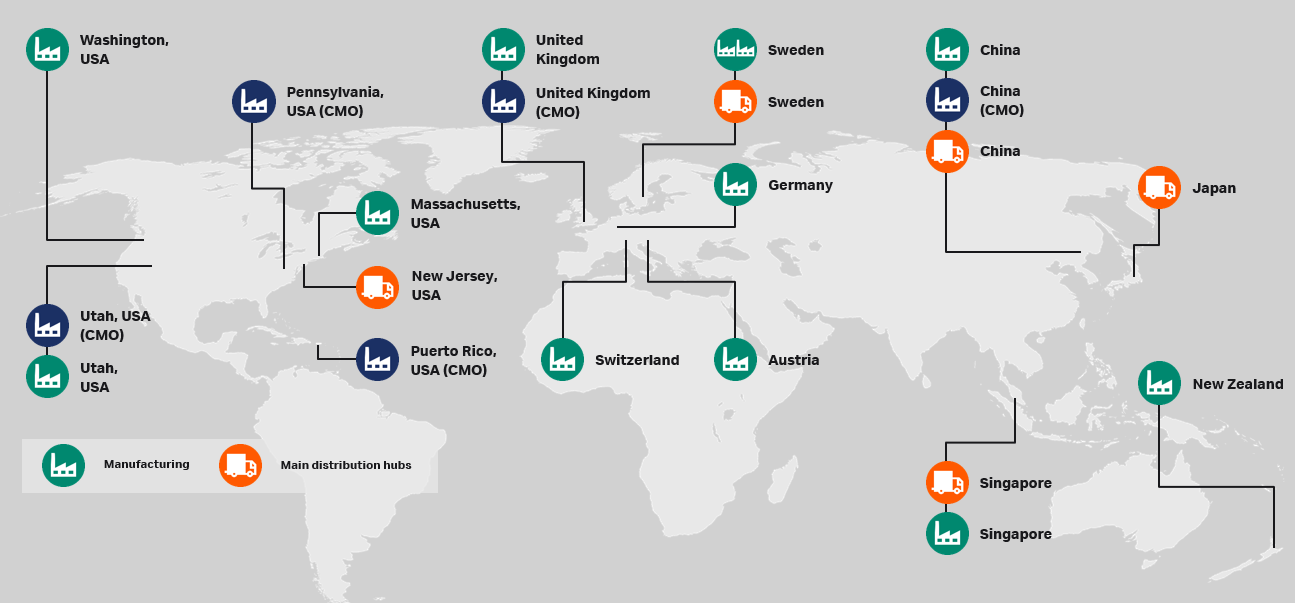

The demand for single use hardware and consumables experienced unparalleled growth in 2020 and 2021. Manufacturing capacity, labor shortages, and material availability have all contributed to industry disruption and longer lead times. Overall, I think the industry’s supply chain is becoming more resilient. For example, at Cytiva, we’re working very closely with customers and suppliers to build more security of supply in our manufacturing network. In some parts of the industry, there are still disruptions due to shortages of certain materials, but I feel that Cytiva’s supply chain is stronger now more than ever before because of the investments we’ve made globally. Cytiva was able to quickly ramp out the production capacity of single use assemblies in China to meet the demand of customers in the Asia region – with many of them manufacturing COVID-19 vaccines for COVAXX.

Have you noticed any emerging trends in collaborations or customer relationships throughout the pandemic?

In our experience, customers have been very flexible and adaptive throughout the pandemic. Given the supply challenges and material constraints, they have partnered with us to provide a more granular view of their product needs. And that enhanced demand signal has allowed us to lessen the disruption in the industry.

Customers have also been very supportive in qualifying new manufacturing sites and new vendors. The security of supply is improving dramatically, and we are working very hard to partner with customers to provide high quality products from an expanded supply base.

Digital transformation has been accelerated during the pandemic because of increased demand and the need for efficiency. What action is Cytiva taking in this area?

Like so many other industries, there is much to be learned and applied by capturing and analyzing process data. With the right digital tools, we can help our customers optimize the performance of their equipment and eliminate unwanted variation between batches. Cytiva’s Integrated Process Development platform, for instance, enables customers to quickly optimize and scale their operations. The pandemic has made on-site customer supports difficult. We have deployed a custom Computational Fluid Dynamics (CFD) tool, without charge, to address customers’ manufacturing deviation issues and bioreactor scale up challenges. And our bioreactor scaler tool helps customers efficiently scale their processes up or down. Understanding the importance of educating our customers on our equipment design and operation principle, Cytiva moved very quickly to implement virtual Factory Acceptance Test (FAT) during the early days of the pandemic, ensuring no customer would miss out on learning opportunities These are just a few examples of how we’re driving digital solutions within the industry.

How else is Cytiva reacting to the pandemic to better support customers? And what other trends do you foresee in the industry – such as regional organization and future capacity planning?

Cytiva’s supply base has expanded rapidly to support broader “in region – for region” supply capabilities – and this has also enhanced our near- and long-term security of supply position for customers.

I’d also like to highlight the fact that Cytiva is leading several key initiatives in sustainability. Our mission of advancing and accelerating therapeutics is our “north star”, but we also have a plan and strategy to deliver on our impacts for people and our planet and grow in the process, which very much aligns with the United Nations’ Sustainability Development Goal. Our sustainability plan is a strategic intention focusing on designing sustainability into our policies, processes, and collaborations across the value chain with measurable targets on value creation to our customers, society, the environment and our associates.

Supply chain resilience is just one lesson that can be learned from the pandemic. What other lessons have been learned in terms of improved processes and efficiency in biomanufacturing?

The biopharma industry is notorious for requiring (or demanding) high levels of customization in hardware and consumables. However, as we partner with our customers, we’re finding unique opportunities to drive more configured solutions, which will drive more scale and efficiency while reducing lead times.

Overall, I think the biopharma industry has learned many lessons from the pandemic. The industry has been becoming increasingly reliant on global supply chains over many years – driven by cost efficiencies through economies of scale. COVID-19 didn’t necessarily create supply chain challenges, but rather highlighted the need to reevaluate operational strategies and more effective collaboration. For example, better supply chain design for suppliers, and increased regional production while securing stronger networks with raw material suppliers globally to enhance security of supply. The industry should collaborate on efficient supply chain information sharing while leveraging other industries’ best practices, and evaluation of sustainable materials to mitigate the risk from scarcity of natural resources.