Unexplored and emerging markets are an attractive prospect for biopharma companies looking to expand. But when it comes to ensuring success, what’s the wisest way to invest?

By Günter Jagschies

No matter how you choose to define them, “emerging markets” represent an enormous physical area that is both culturally and economically diverse – and it represents a rich business opportunity for biopharma companies. Emerging markets range from extremely poor countries, such as in Sub-Saharan Africa and Southern Asia, to middle-income countries in the former Soviet Union, the Middle East, and South America. In some cases, it can be difficult to decide what constitutes an emerging market; China, for example, is an economic power, but looking specifically at healthcare development, you could argue that it is still an emerging market.

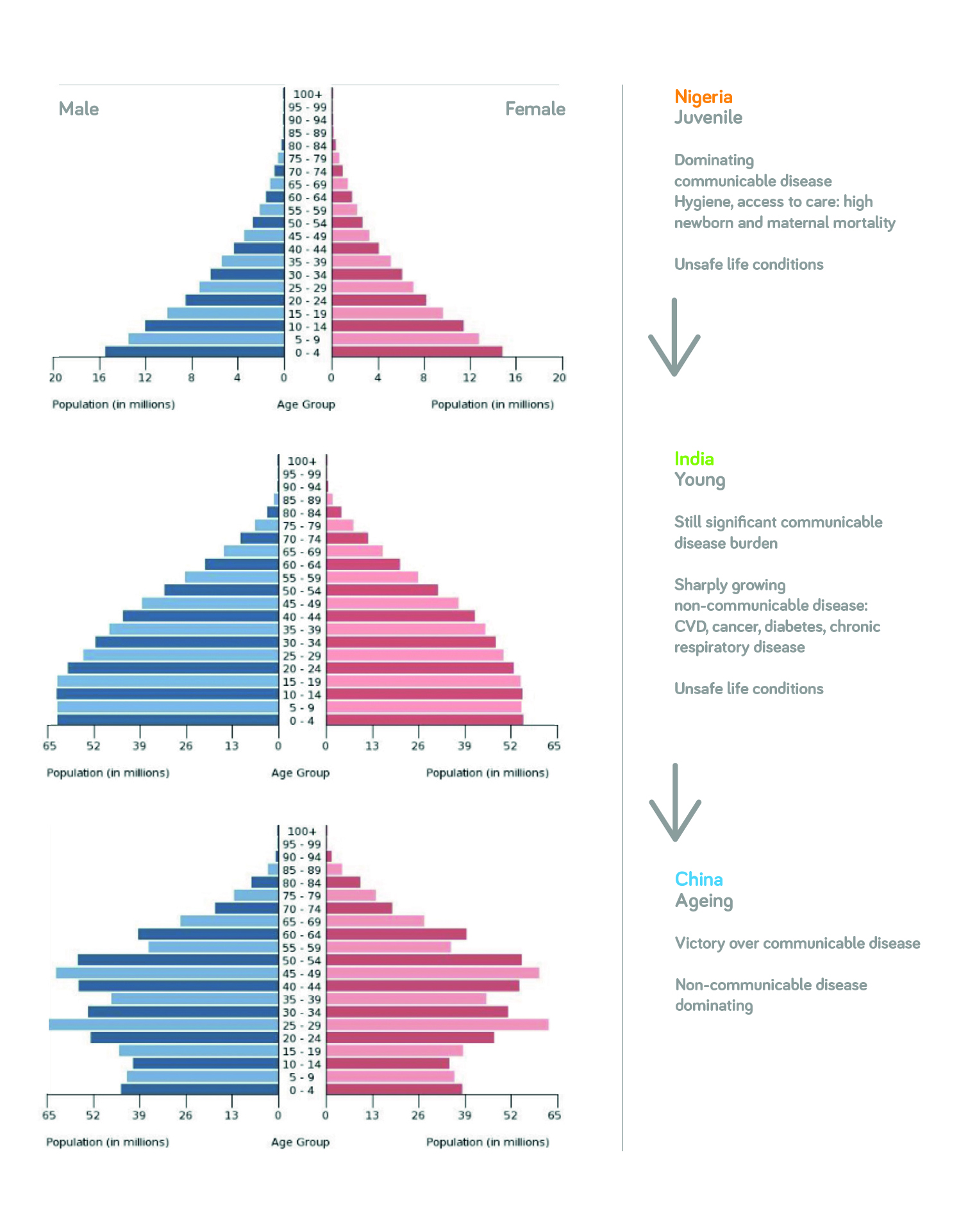

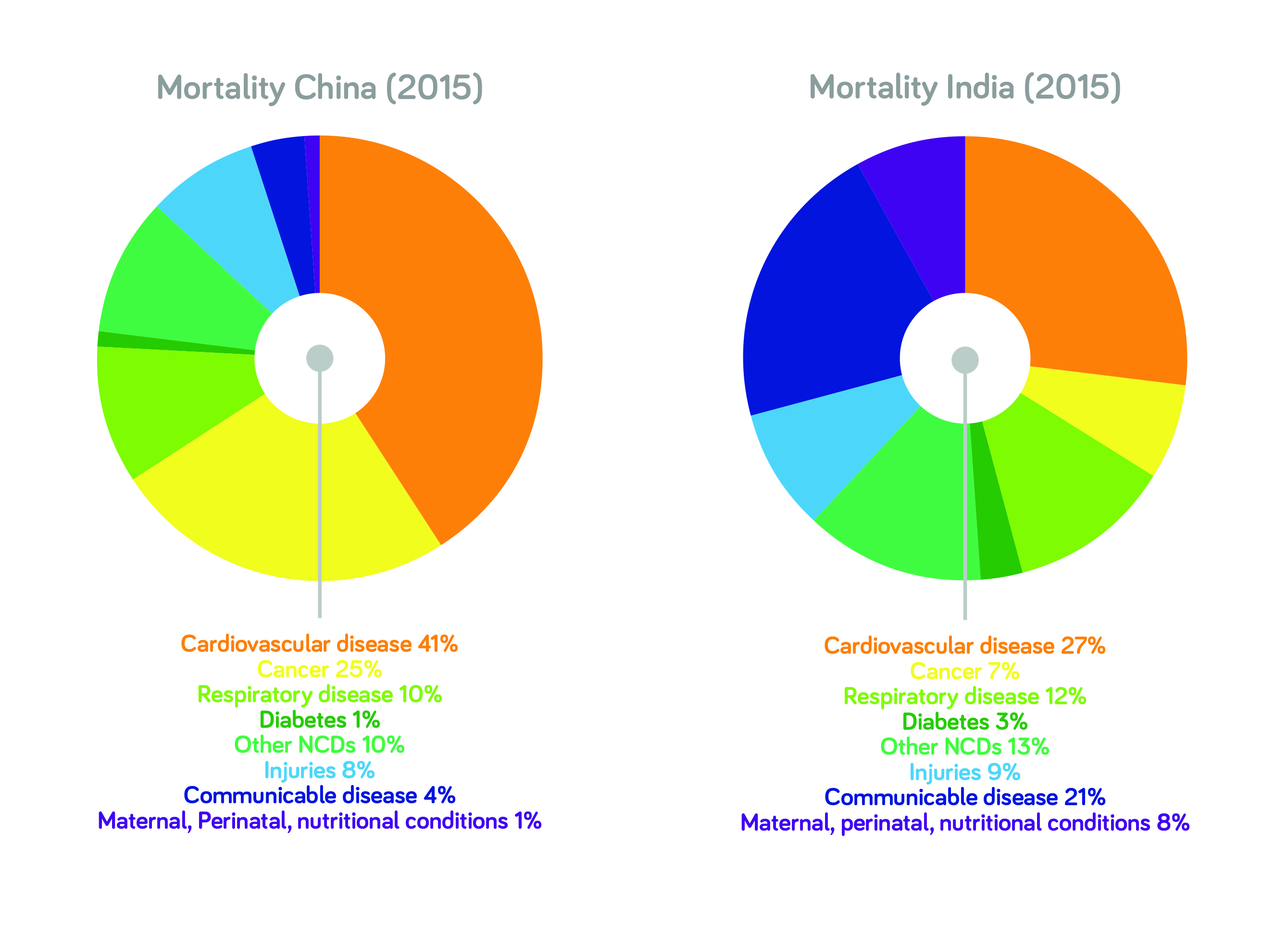

In some emerging markets, there are areas where many people don’t have access to biopharmaceuticals – or even the most basic healthcare resources. At the other end of the spectrum, there are also populations that are getting wealthier and can afford more advanced medications (see Figures 1 and 2). That group could be, in terms of population, as large as the whole of the European Union and North America put together – and it’s likely to show further significant growth.

Fig 1. Demographic transitions in mortality from communicable to non-communicable disease.

Why invest now?

In many emerging countries, the regulatory environment is changing and improving. For example, China is rapidly moving forward thanks to a huge effort to adopt more stringent regulations akin to the US FDA. These changes are expected to facilitate faster approval processes and inspection procedures, and make things more predictable for companies hoping to take a new drug to market in China. There are similar changes happening in India with moves to tighten the regulatory environment, and many countries are also offering new opportunities to collaborate and reach some very rapidly growing populations. In Russia and Brazil, for instance, the governments are encouraging investments that enable the creation of more local players to reduce dependence on imports – a drive that has given rise to smaller operations focusing on local supply, who plan to grow their market access and expand their product portfolios.

In particular, there is huge worldwide demand for biosimilar products – in both emerging and more established markets – because they represent access to advanced biopharma medicines at lower prices than their originator counterparts. Many companies have chosen to focus on biosimilar development, which is also stimulating education and funding programs to supply people with the necessary skills to work in the required facilities.

Fig 2. Mortality profiles in China and India.

Facing barriers

The emerging markets are not for everyone, and there are specific challenges that companies must face head on to be successful. In my view, three hurdles in particular tend to be the most daunting:

1. Price

Many emerging markets demand low pricing levels, and so companies must be prepared to adapt. Have you considered how you will gain access to (or preference of) national purchasing bodies? In many cases, the purchase of biologics and general drugs is conducted through a tender process – in other words, any company that has as a drug directed against the medical indication specified can compete. In this economic climate, companies have few options: if they want to play, they will almost certainly have to adjust their cost structure including manufacturing and commercial costs; they are facing local competition that may be prepared to accept lower profit levels and thus may need to take a conscious decision to do the same at least in an “experiment” to see if such strategy can gain a significant enough share of these rapidly growing markets; in principle, a company may of course also opt out of playing in markets with less attractive economic constraints. The latter, however, may lead to a long-term “lock-out” from future markets and may be considered too short-term focused as a viable strategy:

2. Intellectual property (IP)

In my experience, companies are hesitant to enter certain markets or refuse to transfer the manufacture of new technologies to emerging markets, because of IP concerns. Will your IP be legally/fully protected? Many importing countries recognize the importance of this issue and are examining their laws as an incentive for manufacturers. But the reality is, without strong IP laws, manufacturers run the risk of losing know-how to another company that can copy the process and undercut on price. To avoid giving away business secrets, some companies opt to export the fill and finish operations, shipping the already produced product in from elsewhere. But this is increasingly difficult, and we are now seeing more and more biopharma businesses prepare to get more directly engaged, especially in the Asian region.

3. Hiring the right staff

There may be a talent crunch (and particularly educated management) in the area you wish to set up operations. In my own experience, there is also a tendency for people to seek new opportunities after just a few short years with a company; for example, in the time it took to visit the same site twice, I’ve seen the entire management team change over! I think in some ways this dynamic employment environment is one of the biggest issues when it comes to establishing an operation in an emerging market, and I find the problem particularly pronounced in India and China. Companies establishing operations in dynamic markets where large parts of the population are still on their way out of poverty and into a level of wealth that we assume as a given in developed economies will need to be creative about their incentives to convince key people in management, and really talent at most levels, to stay with them. Local and regional initiatives to grow the numbers of people with adequate education and to offer opportunities to grow experience and practical skills can be created, or supported where they already exist. And don’t forget the other things that draw people to a job – your employees have families and lives outside of work, and there may be non-monetary ways in which you can support and reward them. But be aware that things can vary widely between countries and cultures.

Other top tips for success

So what else does it take to succeed in an emerging market? It’s important to remember that all countries are different – and it’s wise to have support and advice from someone who knows the country in question and has detailed knowledge of its regulations. You need to consider numerous aspects, including financing, approval processes, legislation and geography. The political situation is another crucial point – and a potential minefield for the unprepared! It’s not always easy to predict the political conditions in certain areas, and you may encounter autocratic regimes, unrest, or corruption. One a personal level, I find it helpful to remind myself that it was not so long ago that my own home country and many others with well-established economies were facing their own difficulties. This can help keep you motivated to find solutions to the challenges you face. It’s important to consider the people you work with in these markets as colleagues and friends, not just a part of a “risky” business environment.

Of course, no company wants to find themselves unwittingly involved in anything illegal or unsavory – so your approach needs to be carefully mapped and planned to ensure that everything runs both smoothly, and on the right side of the law. It’s critical that you adhere to all of the rules and legislations, but that won’t be possible if you aren’t aware of them.

My final tip would be: collaborate! At GE, we are offering close collaboration with companies who want to move into new markets. GE has a presence worldwide and people located in almost every single emerging market, giving us unique knowledge and insight, which we are happy to share with clients. I strongly believe that the future of the biopharma industry will involve much more symbiotic relationships between the industry and technology providers, with a move away from the typical transactional relationships we see now. We need to address challenges and embark on new opportunities together for the benefit of both our business and ultimately – and most importantly – for patients.

Günter Jagschies is Senior Director of Strategic Customer Relations, Cytiva, Freiburg, Germany.