In the fall of 2020, Frost & Sullivan took part of a series of events highlighting growth opportunities in the Chinese biopharma industry. These events included the “Think Big Biomedical Innovation Project” sponsored by Cytiva, which helps innovative biotech start-up companies to integrate resources with investment institutes and bio-parks, and the China Pharmaceutical Equipment Engineering Association’s Annual Meeting – the “Biopharmaceutical Forum.”

These events highlighted current and forecasted industry shifts and identified opportunities for growth and innovation coming from Chinese biopharma organizations. In this article we present insights from attending experts from across the range of biopharma support infrastructure.

Areas of growth in China’s biopharmaceutical market

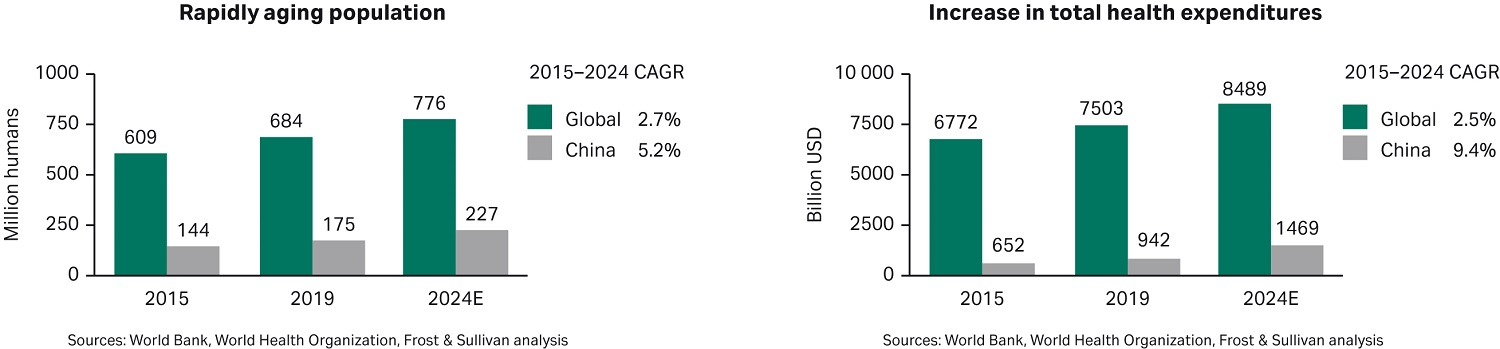

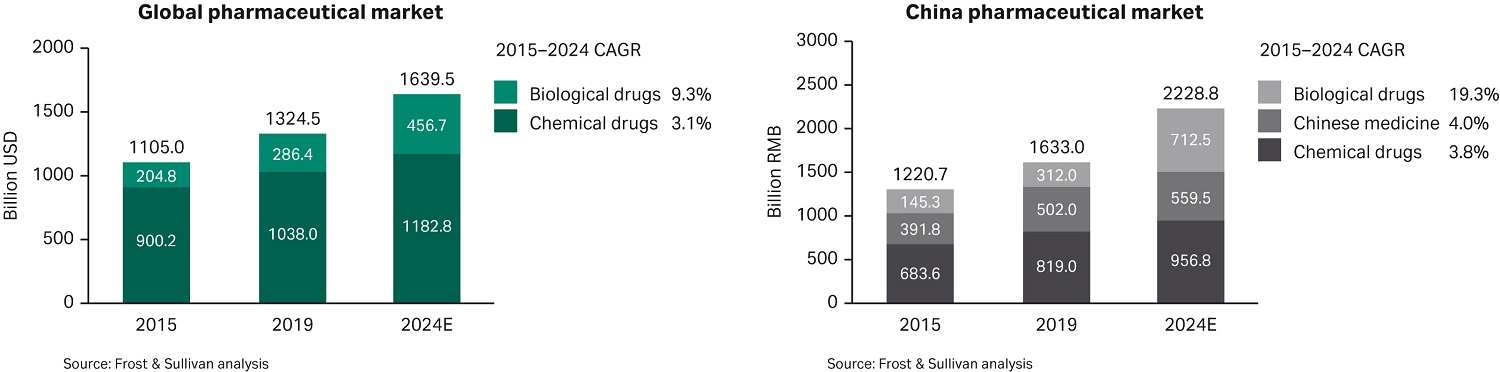

Fred Mao, a partner at Frost & Sullivan Consulting, presented a report entitled “The status and trends of the biopharmaceutical market.” In highlighting the macro market, this report clearly outlined the rapid growth opportunity in the Chinese biopharmaceutical market. Figure 1 shows some of the key drivers of the healthcare sector in China. The biopharmaceutical market in China is expected to have a compounded annual growth rate (CAGR) of 19.3% over the period of 2015 to 2024, far exceeding the global growth rate of less than 10%, as seen in Figure 1.

Fig 1. Market size and compound annual growth rate (CAGR) from 2015 to 2024 for China alone vs global growth.

Much of this growth is driven by demographic trends (China’s aging population is expected to grow by nearly 30% during the period 2019–2024, more than twice the global rate), rapidly expanding health expenditures (China’s total health expenditures are forecast to grow almost 56% during 2019–2024, more than 4 times the global average), and Chinese government policies designed to encourage innovation in the biopharma industry.

On examining different biopharma sectors, Frost & Sullivan analysis shows that overall market growth by 2024 will be driven by biologics, particularly antibodies — sectors where China’s current sales lag in comparison to global benchmarks. Vaccines are another key sector seeing rapid growth, with predicted market growth of nearly 22% between 2015–2024 — over twice the global average expected for this period. (Note: This rapid growth in the vaccines sector in China was observed before COVID-19 vaccine development, but it has also been accelerated during the pandemic.)

Fig 2. Market size and compound annual growth rate (CAGR) from 2015 to 2024 for biological drugs, chemical drugs, and Chinese medicine.

In the area of antibodies and vaccines, China is in the very early phase of the life cycle of innovation, development, regulatory approval, and marketing. As the Chinese market matures, it will help define the direction of research, innovation, and development in this industry segment. Government policy in China is aligned to encourage more innovation and R&D investment by domestic biopharma organizations in the areas of generics, biologics, and cell and gene therapies. Examples of regulatory policies that encourage R&D include:

- In September 2020, China’s National Medical Products Administration (NMPA) released new regulations and proposals designed to encourage first generic drugs (FGD) through a 12-month market exclusivity proposal, providing a payoff to reward and provide ROI for development costs (1).

- China’s National Healthcare Security Administration (NHSA), which oversees state-sponsored public health plans, and is also responsible for centralized purchasing of drugs and medical supplies, has raised market expectations that centralized procurement of biosimilar drugs could be imminent.

- In 2019, the Ministry of Commerce and the National Development and Reform Commission published a “negative list,” forbidding foreign investment in Chinese cell and gene therapies. The aim is to stimulate investment in local research efforts, and partnerships by non-Chinese companies looking to engage in cell and gene therapy R&D in China (2).

- The National Health Commission (NHC) and the NMPA have released a series of policies since 2018 to better define regulations for cell and gene therapies, including confirming the regulatory pathway for autologous cell therapies, and proposing initial technical manufacturing and quality standards for these products (3).

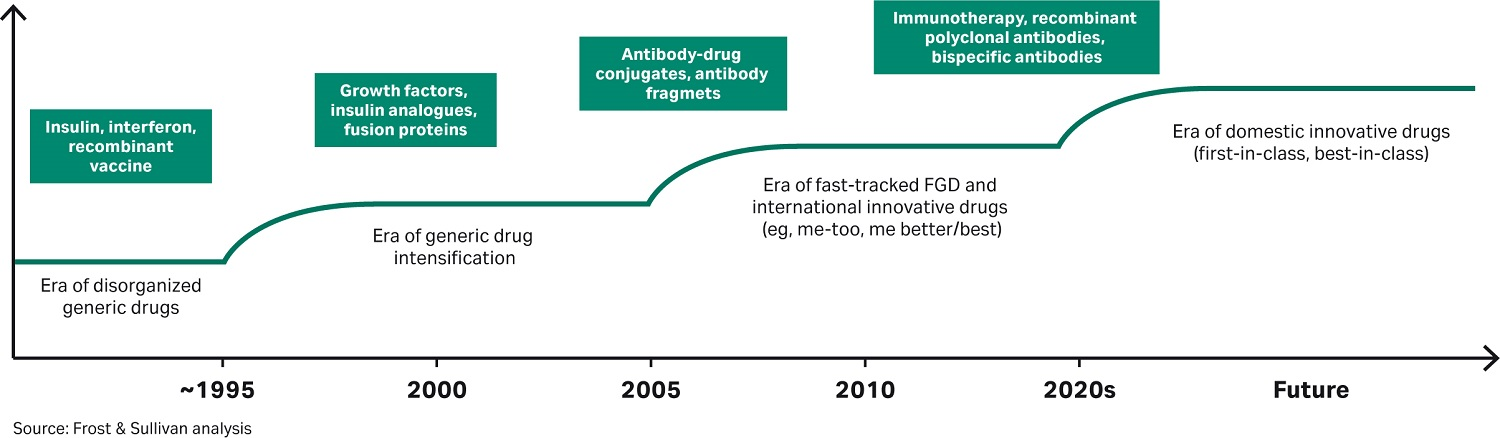

The stages of development of the Chinese pharmaceutical industry are shown in Figure 3.

Fig 3. Chinese pharmaceutical industry stages of development.

As a result of these policies and the strong investment climate for biopharma research in China, we have seen thousands of new patents filed, and technology advancements in R&D and development processes. In the area of micro-technology, major innovations are taking place in advanced bioprocess and full-process solutions. These innovations include upstream microcarrier and irrigation culture technology, and new processes in cell culture. Companies have also developed high-efficiency antibody capture in order to achieve cost effective therapies.

Challenges with funding and maintaining progress in innovation

As experienced by their counterparts in other parts of the world, startups in China have discovered that funding is a major challenge that must be addressed, and investors need to be regularly updated on progress in innovation. As Ms. Yu Lihua, General Manager of Cytiva Greater China noted, “In a survey of start-up and R&D companies, we found that 67% of the respondents mentioned raising funds as the primary goal, and 65% of the respondents believed that maintaining innovation is the vitality of the company, and more than half of the respondents said that they are actively seeking cooperation with CROs, CDMOs, bio-park owners and major pharmaceutical companies.”

Dr. Wu Hongzhong, Executive Director of TASLY Capital, pointed out that preparing a high-quality business plan is a key step in financing. The business plan needs to include analysis of market trends and opportunities, existing problems that the company is targeting, and how these existing problems can be solved.

New bioprocesses

Discussions during the Biopharmaceutical Forum highlighted recent advances in new therapeutic research and development. Also of note were the services and enterprise solutions intended to fully empower the biopharmaceutical industry into the future. These developments highlight China’s growing success in building their domestic biopharma market, and the larger role these products will play in the global market in the future.

Developments in vaccines

Naturally, vaccines were a major topic of discussion, and delegates learned that an inactivated vaccine developed and manufactured in China had entered Phase III clinical testing. The development and manufacturing process used disposable products that can be easily adapted to viral adenovirus vector or DNA-mRNA vaccines, accelerating the full R&D process.

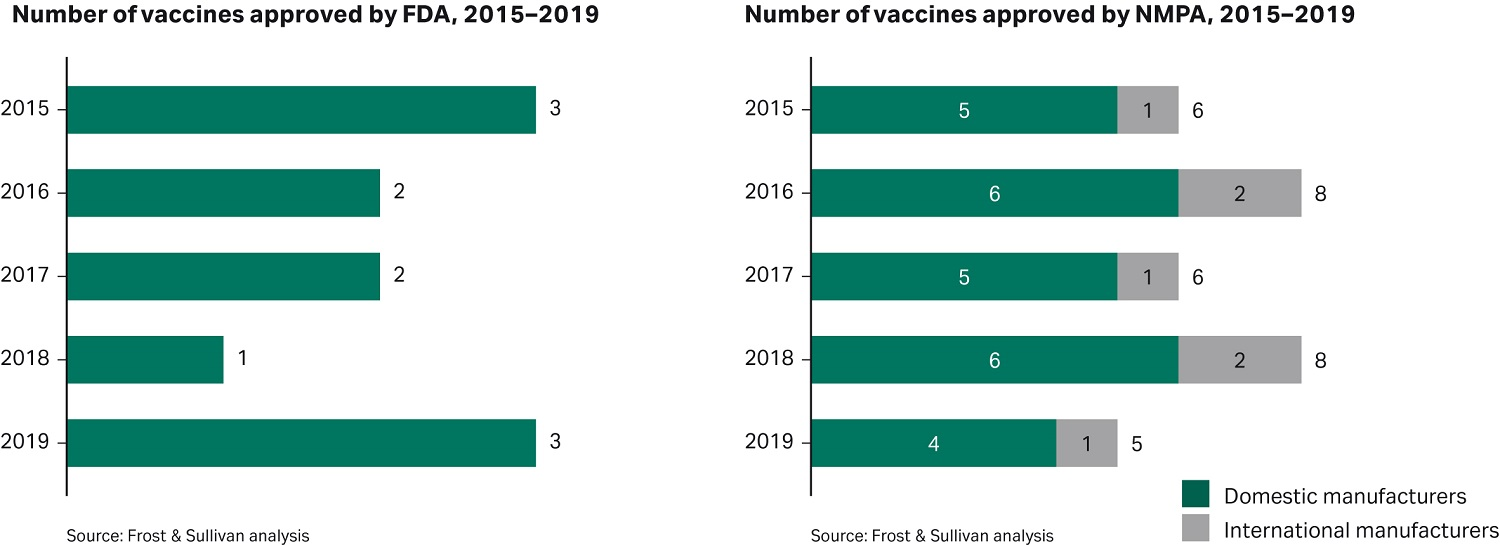

Figure 4 shows the number of vaccines approved in both the US and China during the period 2015–2019, indicating the existing high level of activity in the Chinese market in this sector prior to the COVID-19 pandemic.

Fig 4. Number of vaccines approved by FDA and NMPA between 2015 and 2019.

New developments in vaccine traceability

Mr. Xu Hua, Deputy General Manager of Macroprocess New Technology, continued the vaccine discussion by introducing an approach to meet the national requirement to establish a drug information traceability system. He discussed the current status of the vaccine data traceability system, and he ended discussing the strengths of blockchain technology in developing a track and trace solution based on blockchain’s decentralized data model and the tamperproof audit trail it enables. This will help to ease regulatory requirements on manufacturers to comply with the ability to trace the origin of any marketed products.

Upstream bioprocess

Dr. Yang Jianjun, Cytiva China FastTrak™ Upstream Leader and Mr. Liu Changjun, Cytiva China Senior Product Manager, discussed advancements in biological process development in relation to vaccine development. One significant example discussed was the use of microcarrier beads in upstream cell culture. Dr Yang reviewed the use of microcarrier perfusion culture and the application of disposable bioreactors in the efficient production of vaccines, summarizing the high-efficiency production path of vaccines via a single-use production platform.

Mr. Liu introduced advancements in the upstream culture process of monoclonal antibodies, from the exploration of different cell culture methods to the introduction of a new automated perfusion system (APS) based on tangential flow filtration (TFF) technology.

He also reviewed a Bioreactor Digital Twin (BDT) model for optimizing the culture process scaling. BDT digital modeling is created when the physical, biological, and chemical properties of the process are converted to digital format to enable a complete statistical analysis of product quality. The resulting “transfer functions” connect the asset or process quality output variables to the process and raw material variables at each level of the value stream. This speeds up the discovery process, allowing R&D to predict cell culture deviations rather than investing time and money to develop batch after batch of new product to experiment on. Leveraging these types of digital models, a 10-day batch process can be simulated and analyzed in 30 minutes, greatly accelerating the timeline of discovery, from hypothesis to experimentation to analysis and interpretation of results.

Downstream bioprocess

In the area of new downstream processing, Ms. Liu Jing, Cytiva China Application Director and Mr. Chen Cheng, Cytiva China Senior Product Manager, discussed high-density irrigation culture and high load protein A purification products with high alkaline stability. They also reviewed antibody bioprocess platforms such as single-use technology. Topics introduced were:

- MabSelect PrismA™ filter plates

- Flexible platforms for efficient production

- Long-life platforms

Through rapid process development and amplification there can be a reduction in cash flow expenditures for antibody projects. A new development in the next generation of ultra-fast antibody capture technology uses Fibro PrismA™ units. This fiber-based technology enables rapid cycling chromatography – with huge time savings compared to traditional resins – and it caught the attention of the participants.

It’s clear that flexibility, speed, efficiency, and compliance are future trends in the biopharmaceutical industry. To these ends, four downstream production platforms can accelerate the commercialization of biopharmaceuticals. These downstream platforms are:

- Single-use downstream production – accelerates process transfer

- Continuous flow – helps break through downstream bottlenecks such as tomography and differences between tomography columns

- Online dispensing – can meet the challenges of large-scale downstream dispensing thus saving costs and improving robustness

- Open self-control – helps build intelligent plants

The last word

These events for biotech start-ups helped to promote their organizations and provide valuable advice and insights from leading key opinion leaders in the Chinese biopharma sector. Leveraging these partners and networking allows start-up companies to utilize their limited resources to maintain focus on key development efforts, while enabling continued progress on other necessary activities.

As the biopharmaceutical sector in China is growing rapidly, and a high volume of activity has been seen by both small and large biopharma companies there, those biopharmaceutical companies who progress through the development stages rapidly and efficiently will gain a competitive advantage in approvals, time to market, and eventually market share. Working efficiently requires utilizing best practices, something that development partners can bring to start-ups, which have limited personnel and resources.

- Li H. One year market exclusivity for generic drugs under China’s patent linkage plan. BioCentury, Inc. Updated September 16, 2020. Accessed July 9, 2021.

- Xie D, Ma MY. Winning in the cell and gene therapies market in China. Deloitte. Updated May 5, 2020. Accessed July 9, 2021.

- Yang B. China Regulatory Express: 12 months exclusivity proposed for first generics. Informa UK Limited. Updated September 15, 2020. Accessed July 9, 2021.